Attain Your Desires with the Support of Loan Service Professionals

Attain Your Desires with the Support of Loan Service Professionals

Blog Article

Discover Reliable Finance Solutions for All Your Financial Demands

In navigating the vast landscape of financial services, finding dependable financing carriers that deal with your details requirements can be a difficult job. Whether you are thinking about individual car loans, on the internet lenders, lending institution, peer-to-peer borrowing platforms, or entitlement program programs, the choices appear limitless. Amidst this sea of choices, the essential concern remains - how do you discern the trustworthy and dependable methods from the rest? Allow's check out some key variables to take into consideration when seeking car loan services that are not only reliable however also tailored to fulfill your distinct economic demands - Financial Assistant.

Kinds Of Personal Financings

When thinking about individual car loans, people can select from various kinds customized to satisfy their specific monetary demands. For people looking to consolidate high-interest financial obligations, a debt combination loan is a feasible option. Furthermore, people in need of funds for home improvements or major purchases might opt for a home renovation finance.

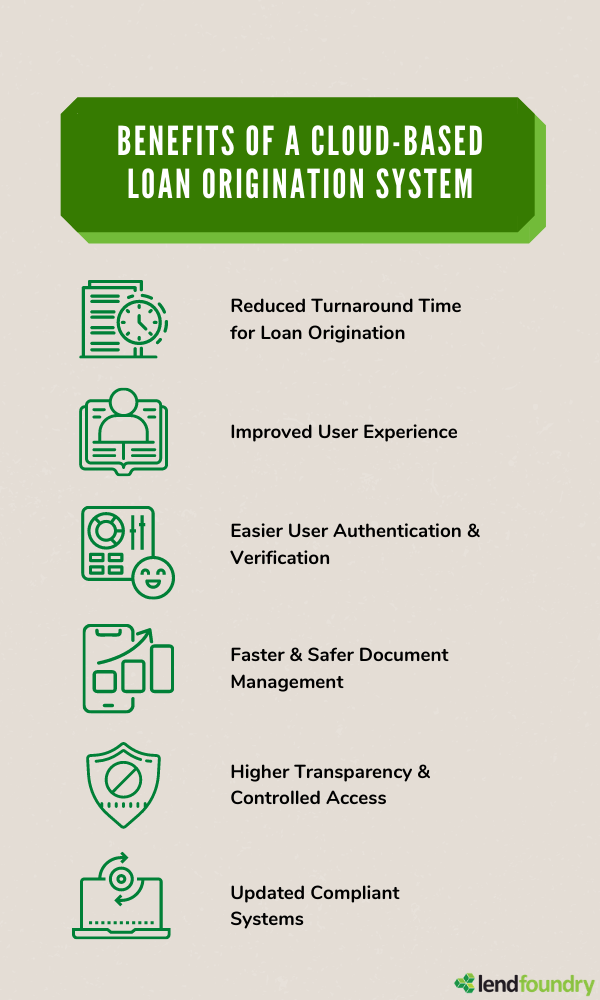

Advantages of Online Lenders

Comprehending Cooperative Credit Union Options

Credit rating unions are not-for-profit economic cooperatives that offer a variety of items and services similar to those of financial institutions, consisting of savings and inspecting accounts, financings, credit report cards, and much more. This possession structure often translates into reduced costs, competitive passion prices on car loans and financial savings accounts, and a solid focus on client solution.

Cooperative credit union can be interesting people trying to find an extra personalized method to banking, as they normally focus on participant contentment over profits. In addition, debt unions usually have a solid community presence and might provide monetary education resources to help members boost their economic proficiency. By recognizing the alternatives readily available at cooperative credit union, people can make educated decisions about where to leave their monetary demands.

Checking Out Peer-to-Peer Borrowing

One of the crucial tourist attractions of peer-to-peer borrowing is the capacity for reduced rate of interest prices compared to standard financial establishments, making it an appealing alternative for borrowers. Furthermore, the application procedure for acquiring a peer-to-peer loan is normally streamlined and can result in faster access to funds.

Capitalists also take advantage of peer-to-peer borrowing by potentially gaining greater returns contrasted to conventional investment choices. By eliminating the middleman, investors can straight fund debtors and obtain a portion of the rate of interest repayments. It's essential to note that like any type of financial investment, peer-to-peer borrowing lugs inherent risks, such as the possibility of debtors skipping on their financings.

Government Assistance Programs

Amidst the developing landscape of monetary solutions, a vital facet to consider is the realm of Entitlement program Programs. These programs play a crucial role in providing financial assistance and assistance to people and services throughout times of requirement. From joblessness advantages to tiny organization lendings, government support programs aim to minimize monetary burdens and promote financial security.

One popular example of a government assistance program is the Small company Administration (SBA) car loans. These car loans provide favorable terms and low-interest prices to assist local business grow and browse difficulties - mca lender. Furthermore, programs like the Supplemental Nourishment Assistance Program (SNAP) and Temporary Support for Needy Households (TANF) give important support for people and family members encountering economic difficulty

Additionally, entitlement program programs expand beyond financial assistance, including real estate click to find out more assistance, healthcare subsidies, and educational grants. These initiatives aim to deal with systemic inequalities, promote social welfare, and guarantee that all citizens have access to basic necessities and opportunities for development. By leveraging entitlement program programs, people and businesses can weather economic tornados and make every effort in the direction of a much more protected financial future.

Conclusion

Report this page